Equity Can Make Your Move Possible When Affordability Is Tight [INFOGRAPHIC]

![Equity Can Make Your Move Possible When Affordability Is Tight [INFOGRAPHIC] Simplifying The Market](https://img.chime.me/image/fs/chimeblog/20240428/16/original_f60e811d-37e0-45d1-8544-53b040b9e4c0.png)

Some Highlights

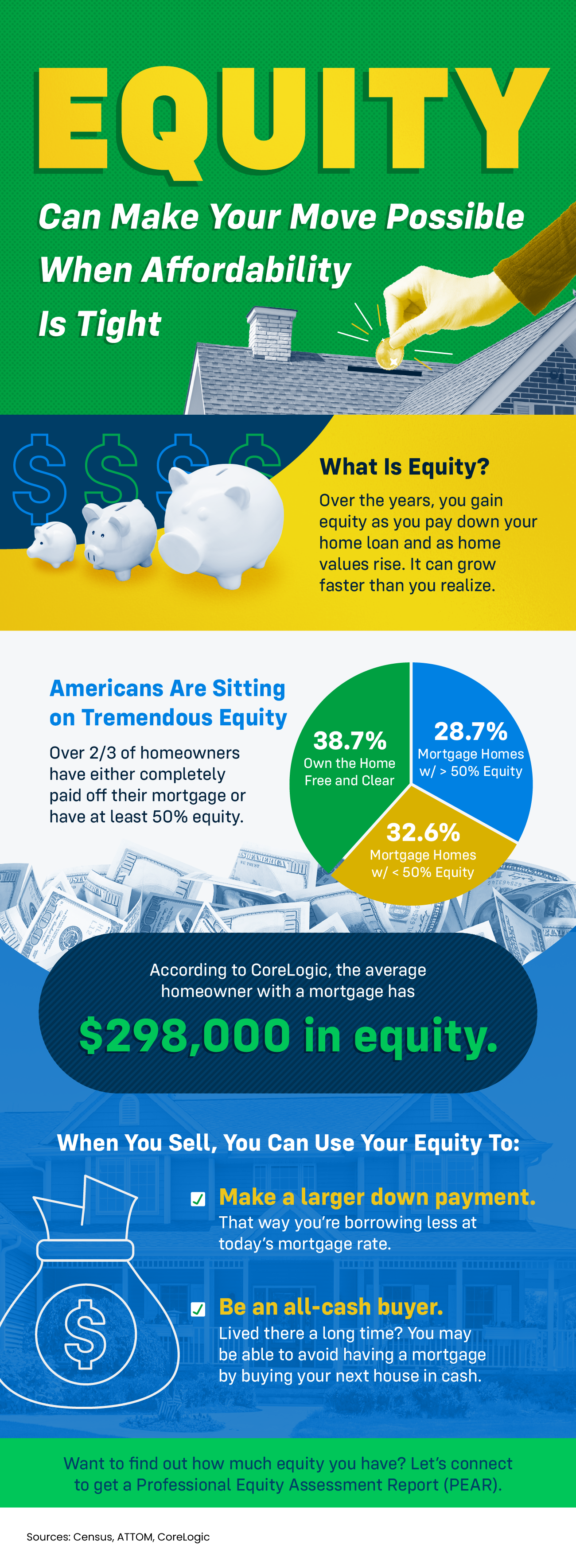

- Did you know the equity you have in your current house can help make your move possible?

- Once you sell, you can use it for a larger down payment on your next home, so you’re borrowing less. Or, you may even have enough to be an all-cash buyer.

- The typical homeowner has $298,000 in equity. If you want to find out how much you have, connect with a local real estate agent for a Professional Equity Assessment Report.

Categories

Recent Posts

What’s Motivating Homeowners To Move Right Now

The Majority of Veterans Are Unaware of a Key VA Loan Benefit

Why You Need an Agent To Set the Right Asking Price

Renting vs. Buying: The Net Worth Gap You Need To See

What To Look For From This Week’s Fed Meeting

Expect the Unexpected: Anticipating Volatility in Today’s Housing Market

Is a Fixer Upper Right for You?

Q&A: How Do Presidential Elections Impact the Housing Market?

How Real Estate Agents Take the Fear Out of Moving

Avoid These Top Homebuyer Mistakes in Today’s Market

GET MORE INFORMATION